How to Calculate Expenses for Your Farm Business

To calculate expenses for your farm business, start by identifying your Cost of Goods Sold (COGS), including seeds, feed, labor, and packaging. Track your operating expenses like utilities and supplies separately using detailed records or software. Don’t forget to account for vehicle, equipment costs, and conservation expenses properly. Apply depreciation methods where applicable and manage prepaid supplies within IRS limits. Staying organized helps optimize your deductions and improve profitability. Keep exploring to uncover more ways to manage farm expenses effectively.

Key Takeaways

- Calculate Cost of Goods Sold by adding beginning inventory and purchases, then subtracting ending inventory to capture direct production costs.

- Separate operating expenses like labor, utilities, and supplies from COGS for accurate financial tracking and budgeting.

- Maintain detailed records using spreadsheets or accounting software to track expenses and support tax deductions efficiently.

- Use inventory management tools to monitor seeds, feed, and supplies, ensuring precise expense reporting and optimized input usage.

- Account for vehicle, equipment, and conservation costs, applying appropriate depreciation methods and tax deductions to reduce taxable income.

Identifying Cost of Goods Sold (COGS)

When you’re calculating farm expenses, it helps to first identify your Cost of Goods Sold (COGS), which covers all direct production costs like animal feed, seeds, labor, and packaging. COGS includes only direct expenses related to producing your goods, such as packaging materials, and excludes operating expenses like rent or insurance. To calculate COGS, you use the formula: (Beginning Inventory Value + Purchased Inventory Value) minus Ending Inventory Value, where inventory values track the cost of your stock at specific times. Knowing your COGS is crucial because it affects your gross profit margins and helps you understand your farm income better. You can also find your COGS percentage by dividing COGS by food sales, giving insight into how efficiently you’re managing production costs.

Tracking Operating Expenses Separately

To keep your farm finances clear, start by categorizing operating expenses like labor, utilities, and supplies separately from other costs. Using tools like accounting software or spreadsheets helps you maintain detailed records for easier tracking. This way, you can monitor spending accurately and make smarter budgeting decisions.

Categorizing Expense Types

A key step in managing your farm’s finances is categorizing operating expenses separately from capital expenditures. Operating expenses cover daily costs like labor, utilities, and supplies, while capital expenditures refer to long-term investments such as equipment. Keeping these distinct helps you accurately assess your farm’s financial health and streamline budget management. Mixing business expenses with personal expenses can create confusion and complicate your tax filings. Your tax preparer will rely on clear categorization, especially when filling out Schedule F, to guarantee you claim the correct deductions. Good record-keeping of these categories not only supports compliance but also highlights areas for cost savings. This clarity empowers better financial decisions and improves your farm’s overall profitability.

Maintaining Detailed Records

Although keeping detailed records might seem time-consuming, it’s vital for tracking your farm’s operating expenses accurately. Maintaining detailed records helps you separate utilities, supplies, labor, and other costs, making it easier to identify eligible expenses for tax deductions. Using spreadsheets or accounting software keeps your records organized and consistent, helping you distinguish between business and personal costs. This clarity guarantees you only claim valid deductions on Schedule F, improving your net farm income. Regularly reviewing your records supports better cash flow management and informed budgeting decisions. By tracking operating expenses separately, you gain valuable insights into your farm’s financial health, allowing you to plan more effectively and avoid costly mistakes. Accurate records are a key tool for running a profitable farm business.

Utilizing Inventory Management Tools

You can keep a close eye on your input usage by using inventory management tools that update automatically as you use seeds, feed, and supplies. These tools help you track exactly what’s on hand without manual counts, saving time and reducing errors. By automating inventory updates, you’ll have more accurate data to calculate expenses and make smarter purchasing decisions.

Tracking Input Usage

When you utilize inventory management tools, tracking the quantity and cost of farm inputs like seeds, fertilizers, and feed becomes much easier, ensuring your expense reporting on Schedule F is accurate. These tools provide real-time insight into input usage, helping you monitor production costs closely and avoid over-purchasing or waste. By analyzing this data, you can make smarter purchasing decisions that improve cost efficiency. Many inventory management systems integrate directly with accounting software, streamlining financial reporting and tax preparation. This integration also aids in calculating the Cost of Goods Sold, giving you a clearer picture of your farm’s profitability. Ultimately, effective inventory management supports precise expense reporting and helps you optimize your farm business financials.

Automating Inventory Updates

Automating inventory updates can save you countless hours and reduce errors by tracking stock levels in real time. Using inventory management software lets you automate updates and track inventory levels with accurate reflections of your available stock. This reduces manual entry and errors by syncing directly with sales platforms to adjust inventory automatically. With built-in analytics and reporting, you can analyze trends and optimize your stock for peak demand, helping you manage costs more effectively. Many tools even offer mobile access, so you can oversee inventory from anywhere. By ensuring timely replenishment and minimizing waste, these systems help improve profitability. Incorporating such technology streamlines your farm’s operations and gives you better control over expenses linked to inventory management.

Calculating Vehicle and Equipment Costs

Many farmers face the choice between deducting actual vehicle expenses or using the standard mileage rate to calculate vehicle costs. If you choose actual costs, you’ll need to track gasoline, repairs, insurance, and depreciation, ensuring you separate business use from personal use. Careful recordkeeping is essential for accurately reporting these expenses on IRS Schedule F. For equipment costs, you can depreciate assets over their recovery period using MACRS or take advantage of the Section 179 deduction to expense up to $1,020,000 immediately. Additionally, bonus depreciation lets you deduct 100% of qualifying new or used equipment costs placed in service through 2022. By maintaining detailed records of vehicle and equipment use and expenses, you can optimize your deductions and clearly justify them during tax filing.

Accounting for Conservation and Fertilizer Expenses

Besides vehicle and equipment costs, you’ll want to contemplate how to handle conservation and fertilizer expenses in your farm accounting. The IRS offers specific deductions and rules under IRC sections 175 and 180 that can impact your tax strategy. Here’s what to keep in mind:

- Deduct soil and water conservation expenses up to 25% of your gross income from farming (IRC § 175).

- Fertilizer and lime costs can be immediately expensed rather than capitalizing and depreciating (IRC § 180).

- Conservation deductions apply only to land actively used for farming and can be carried forward if unused.

- Selling farmland with deducted fertilizer expenses requires reporting unused amounts as ordinary income.

- Both tenants and landlords may claim fertilizer deductions if rent is production-based and landlords materially participate.

Understanding these rules helps you optimize your farming expenses and maximize deductions.

Applying Depreciation and Cost Recovery Methods

When you purchase farm equipment or vehicles, you’ll want to apply the correct depreciation and cost recovery methods to maximize your tax benefits. The Modified Accelerated Cost Recovery System (MACRS) is commonly used to depreciate qualifying property over set recovery periods. You can also elect the actual cost method, but remember, once chosen for a vehicle, you can’t change it later. Under IRC § 179, you can deduct up to $1,020,000 for qualifying property, with limits if purchases exceed $2,550,000. Bonus depreciation allows a 100% deduction on qualifying farm equipment placed in service through 2022. Keep accurate recordkeeping of all expenses related to these assets to support your claims. For vehicles, be aware of depreciation caps under IRC §280F(a). Applying these methods carefully guarantees you get the most from your farm business’s deductions.

Managing Prepaid Expenses and Tax Deductions

After applying depreciation methods to your farm assets, you’ll want to turn your attention to managing prepaid expenses and how they affect your tax deductions. Cash-method farmers can deduct prepaid farm supplies in the year paid but must follow IRC § 464 limits. To properly calculate expenses and maximize your business expense deductions, keep these tips in mind:

- Prepayments for supplies are capped at 50% of other deductible farm expenses.

- You must guarantee expenses directly relate to land used for farming.

- Maintain accurate recordkeeping to track unused prepaid amounts.

- Unused prepaid supplies must be reported as ordinary income if farmland is sold.

- Understanding timing and limits under the IRC helps reduce the amount of disallowed expenses and qualify for deductions.

Following these steps helps you manage prepaid expenses effectively while optimizing your tax benefits.

Frequently Asked Questions

How to Write off Farm Expenses?

You can write off farm expenses by tracking eligible expenses like farm equipment and operating costs, using proper depreciation methods, categorizing expenses, maintaining detailed records, and applying tax deductions based on business use to support your financial planning.

How Do You Calculate Business Expenses?

You’ll calculate business expenses by tracking cost categories like labor costs, equipment maintenance, and input expenses. Use expense tracking and budget planning to analyze financial statements, optimize profit margins, and maximize tax deductions effectively.

What Is the Biggest Expense on the Typical Farmer?

You’ll find labor costs usually top the list as the biggest expense for farmers. Alongside equipment maintenance, feed costs, seed purchases, fuel expenses, land rental, and insurance premiums, market fluctuations also impact your crop insurance and overall budget.

How to Keep Track of Farm Expenses?

While expense tracking might seem tedious, using budgeting tools and digital spreadsheets simplifies it. By organizing expense categories and leveraging financial software, you enhance record keeping, enable cost analysis, maximize tax deductions, and ultimately improve profit margins on your farm.

Our picks

Alpaca & Wool Felted Sole Inserts: Comfy Upgrade?

Best Alpaca Socks for Hiking: Ultimate Comfort and Durability on Trails

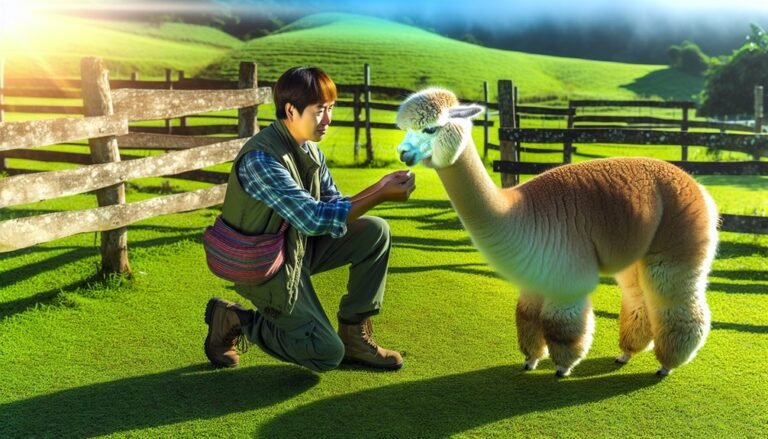

Best Alpaca Halter for Comfort and Control